1. Corporate Tax

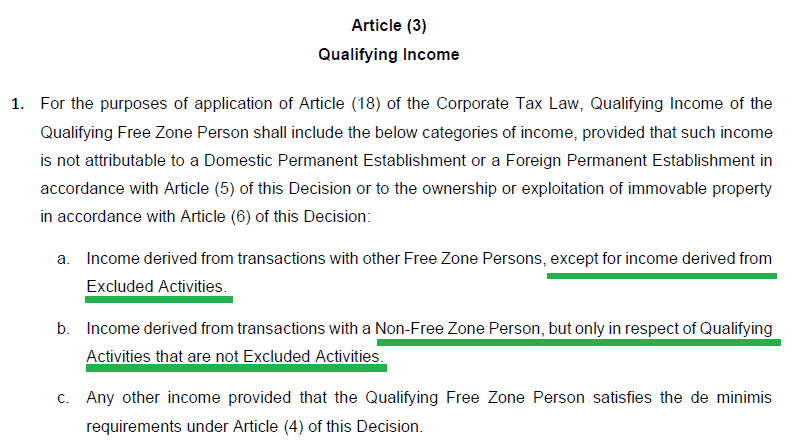

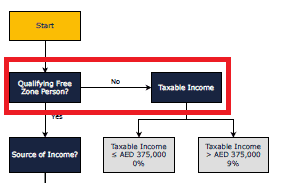

It’s important to understand that the Excluded List of Activities in regards to Qualifying Income for a Qualifying Freezone Person is a conclusively complete list and the Activities not mentioned thereby automatically belong to the List of Qualifying Activities to remain 0% Corporate Tax as described in Article (3) Qualifying Income of Cabinet-Decision-No.-55-of-2023-on-Qualifying-Income.

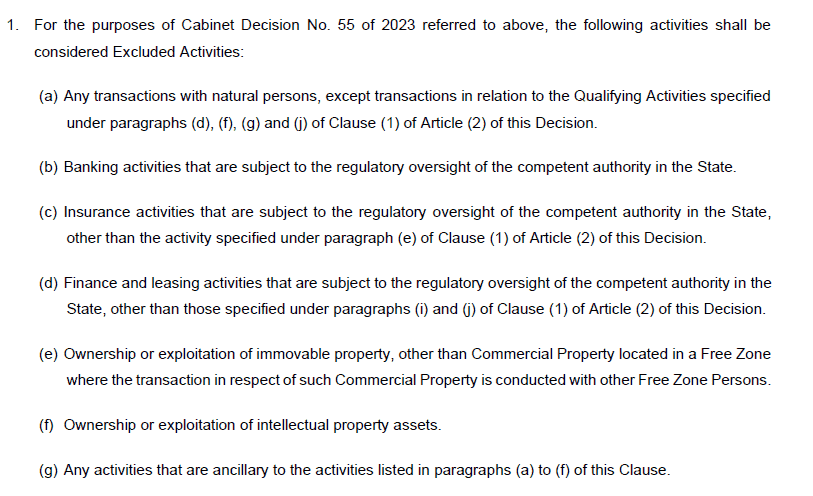

List of Excluded Activities

If you are not conducting Business with the UAE Mainland or have a Banking, Insurance or Finance Business Activity which 99% of DLS Dubai Clients don’t have – you are not part of the Excluded Business Activity List and therefore 0% Corporate Tax applies.

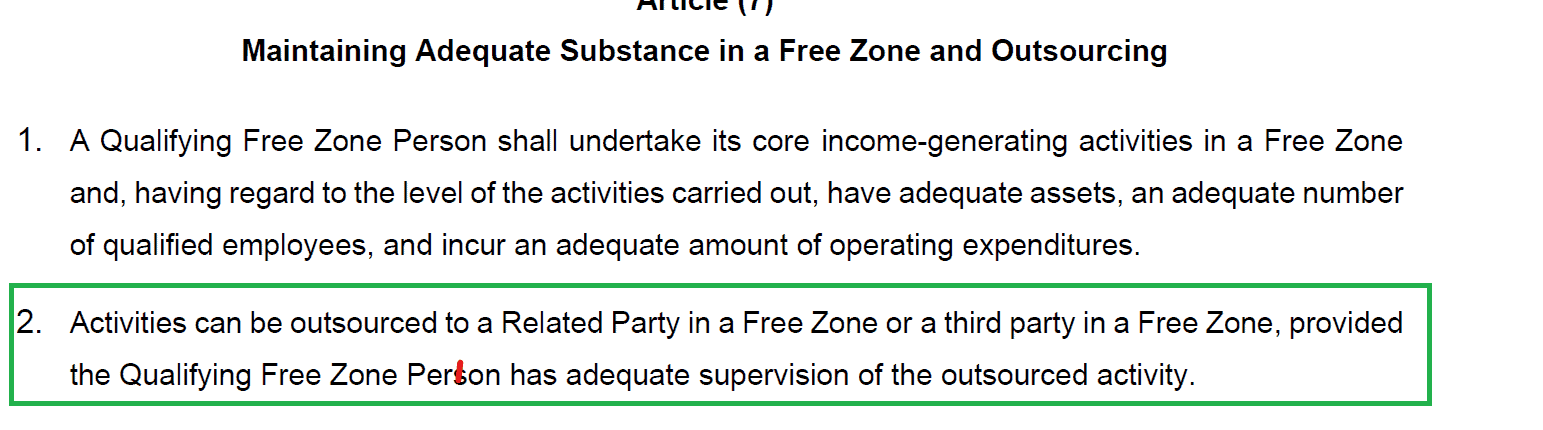

2. Substance

If you are an active reader of our content or an existing DLS Dubai client, you know that we are preaching for almost 3 years the topic Substance and why it is so significant not only for Banks but also to be compliant with the Qualifying Substance Regulations to remain a Qualifying Freezone Person as defined below.

DLS Dubai can provide to all existing clients Administrative Services within the Free Zone as a 3rd Party Service Provider to satisfy 2.) of Cabinet-Decision-No.-55-of-2023-on-Qualifying-Income. We provide you with a Service Agreement for Administrative Services like Corporate Services, Accounting and similar.

DLS Dubai Statement

The earlier mentioned information is the Statement of DLS Dubai and at the same time the Roadmap for existing DLS Dubai clients regarding the Corporate Tax. We roll out all required services to remain 0% Corporate Tax starting today and approach every single existing client with a Personal Discovery Call after the Submission of our earlier sent out Corporate Tax Questionnaire.

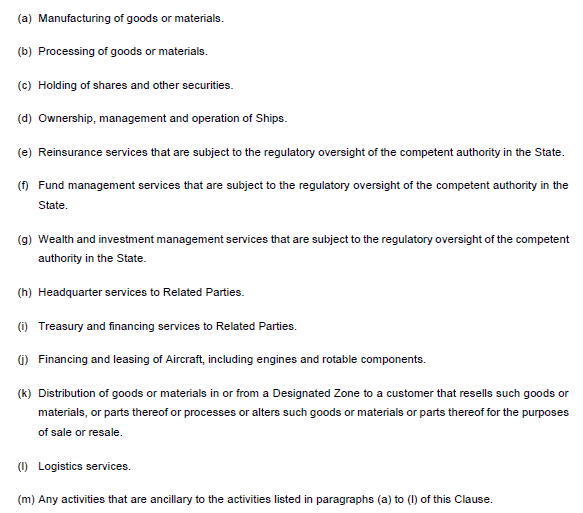

We are aware that there are a lot of readers of our Blog and in General readers of the Content of DLS Dubai which are not existing clients of DLS Dubai and still have a lot of questions or uncertainty in regard to the new Corporate Tax Law in the UAE. The Feedback we got, especially from Freezone Company Owners not related to DLS Dubai have a negative point of view as well, due to a lack of information in regard to the List of Included Activities for Qualifying Freezone Persons from Ministerial-Decision-No.-139-of-2023-Regarding-Qualifying-Actvites-and-Excluded-Actvites (Source).

List of Qualifying Activities

The majority of people who are not clients of DLS Dubai having now issues with this wording as it doesn’t mention explicitly New Economy Business Activities such as E-Commerce, Marketing and IT next to numerous others. In fact, we have as of today, more than 780 Business Activities we can choose from, and technically, it’s impossible to mention all of them in a Ministerial Decision. We mentioned earlier already in 1. Corporate Tax, why it’s not even required to be explicitly mentioned in the List of Qualifying Activities. However, we would like to work with some logical thinking here as well.

Someone needs to ask himself – taking things like Abu Dhabi Vision 2030 into consideration - if the UAE is really after attracting only Old Economy Business like a Metal Manufacturing Company instead of New Economy Business all around Artificial Intelligence, Information Technology and Cryptocurrencies.

In any way, we can think of the assumption that only Activities explicitly mentioned in the List of Qualifying Activities enjoy 0% Corporate Tax doesn’t make sense taking into consideration everything else the UAE in General is after regarding Developing the UAE Economy – Globally and Locally.

You disagree with this? Read further.

High Margin Business Case Study - “Escape-clause”

Max M. owns an Information Technology Consulting Company in a Dubai Freezone and has his Tax Free Residence in Dubai. Max M. is an existing client of DLS Dubai and despite the Roadmap of DLS Dubai and their 0% Corporate Tax Statement – Max M. believes that the Income of his Information Technology Consulting Company is not within the scope of Qualifying Income.

After an initial Discovery Call with the Accountant Manager of DLS Dubai – Max M. does figure out that due to the fact that his turnover is almost equal to his profit (High Margin Business) and his current turnover is around 2 Million AED per year (545K USD) - it makes sense that his Freezone Company is using the “Escape-clause”.

„Escape-Clause“:

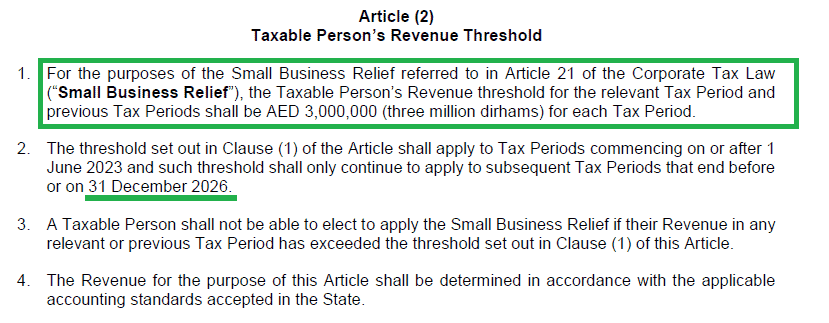

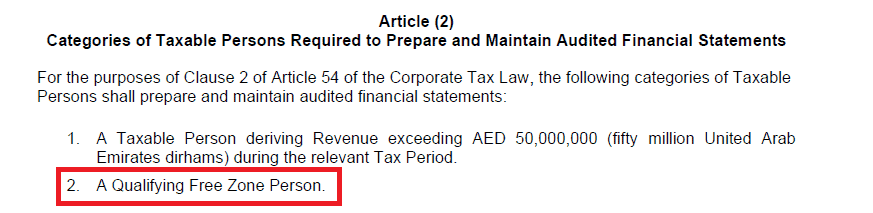

The Freezone Company of Max M. is opting to be handled by the Federal Tax Authority as a Mainland Company by not-providing Audited Financial Statements to disqualify as a Qualifying Freezone Person to benefit from the Small Business Relief of up to 3 Million AED Revenue per year till 31.12.2026.

Max M. now benefits from 0% Corporate Tax without any Audit requirements and can even expand his Business to the UAE Mainland. Max M. can now accumulate over the next 3 Years up to 9 Million AED with 0% Corporate Tax and invest the accumulated Freezone Company Earnings at 0% Capital Gain Tax in Stocks and Cryptocurrencies.

Low Margin Business Case Study - “Worst-Case Tax”

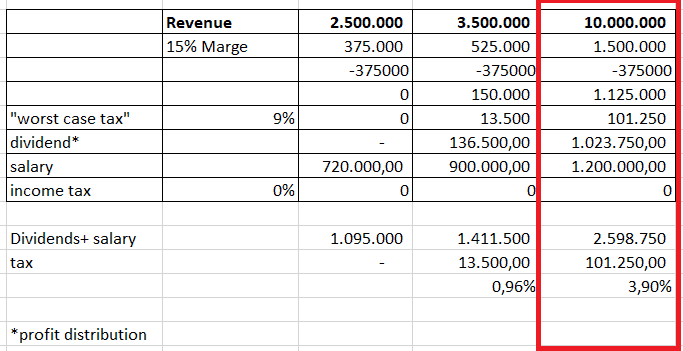

John D. owns an International Trading E-Commerce Company in a Dubai Freezone and has his Tax Free Residence in Dubai. John D. is an existing client of DLS Dubai and despite the Roadmap of DLS Dubai and their 0% Corporate Tax Statement – John D. believes that the Income of his International Trading E-Commerce Company is not within the scope of Qualifying Income. After an initial Discovery Call with the Accountant Manager of DLS Dubai – John D. does figure out that due to the fact that his E-Commerce Business is doing a lot of turnover but only having a 15% Profit Margin (Low Margin Business) and his current turnover is around 10 Million AED per year (2.7M USD) - it makes sense that his Freezone Company is Becoming Creative using a “GAAR” (General Anti Abuse Rule) Compliant Salary Payout in Combination with the first 375000 AED Profit being Tax Free.

DLS Dubai recommends John D. to pay himself a Salary of 90000 AED per Month and another 10000 AED Allowance for Housing and Air Tickets per Month. His total Salary is 1.2 Million AED per Year while Making 10 Million AED Turnover. Additional DLS Dubai recommends John D. to Employee his Girlfriend as well. An optimal Position would be Administrative Assistant with a 35000 AED Salary per Month and another 5000 AED Allowance for Housing and Air Tickets per Month. John D. needs to think about this Idea, which would again smaller his Profits.

John D. is paying himself a Total 1.2 Million AED Salary per Year while he has a 15% Profit Margin with the first 375000 AED being Tax Free which leads to a Total of almost 2.6 Million AED (700k USD) in Salary and Dividend (Profit Distribution) while paying just 100k AED (25k USD) in Tax equal to 3.9%.

John D. now Benefits from 3.9% Corporate Tax which he has to agree is the best deal out there without living on a small Caribbean Island which John D. doesn’t like for Lifestyle Reasons. John D. can now accumulate over the next 3 Years 8 Million AED with 3.9% Corporate Tax and invest the accumulated Freezone Company Earnings at 0% Capital Gain Tax in Stocks and Cryptocurrencies.

“All-inclusive Package Plus”

DLS Dubai can offer you from now on the “All-inclusive Package Plus” with setting up the most affordable 0% Tax Residence in the world by forming a Holding Freezone Company in Dubai in Combination with a Tax Neutral active Trading Company based in a High Tax Country.

The “All-inclusive Package Plus” Setup leads to 0% Corporate Tax for both – Active Trading Company and Holding Company, as well as 0% Capital Gain Tax and 0% Personal Income Tax. We help existing clients of DLS Dubai to convert their current Setup to achieve the “All-inclusive Package Plus”.

DLS Dubai conquers the Challenges of such a Complex International Setup with an extensive Network of Payment Processors, Payment Institutions and Private Banks.